Tokyo, December 6, 2022: Two years ago, Kawasaki Heavy Industries, Ltd., established the Kawasaki Group’s new vision statement, describing what the Group envisions becoming in 10 years ― “Group Vision 2030: Trustworthy Solutions for the Future.” Since then top management have provided regular progress reports on how Kawasaki is progressing on its path to 2030, both in terms of business transformation and advances in three focus fields: safe and secure remotely-connected society, near-future mobility, and energy and environmental solutions.

Looking back on the first two years on the path to 2030, President & CEO Yasuhiko Hashimoto and other Kawasaki executives set out the following key take-home messages:

- In the newly renamed Power Sports & Engine segment, the Recreational Off-highway Vehicles (ROV) business is a robust earnings driver, with plant investment being implemented to expand production capacity.

- The motorcycle business is also responding to diverse market needs, and looking to a carbon-neutral future with electric and hydrogen engines.

- The Rolling Stock segment has returned to profitability for the first time in five years, and the Kawasaki brand has become a trusted presence in the United States, particularly in the New York area, with its R211 railcar becoming a familiar presence.

- Kawasaki is focusing on development of indoor positioning system iPNT-K and related technologies as a promising business field that is attracting much attention.

- The hydrogen business will form a major part of Kawasaki’s business in the future and work is advancing towards the formation of a hydrogen society in 2030.

- Kawasaki is also focusing efforts on development of potential for Direct Air Capture (DAC) technologies, with pilot projects being planned in the U.S.

- By invigorating human resources mobility and interactions among group companies, and also bringing in talent and expertise from outside, Kawasaki is building experience and know-how that will further grow corporate value.

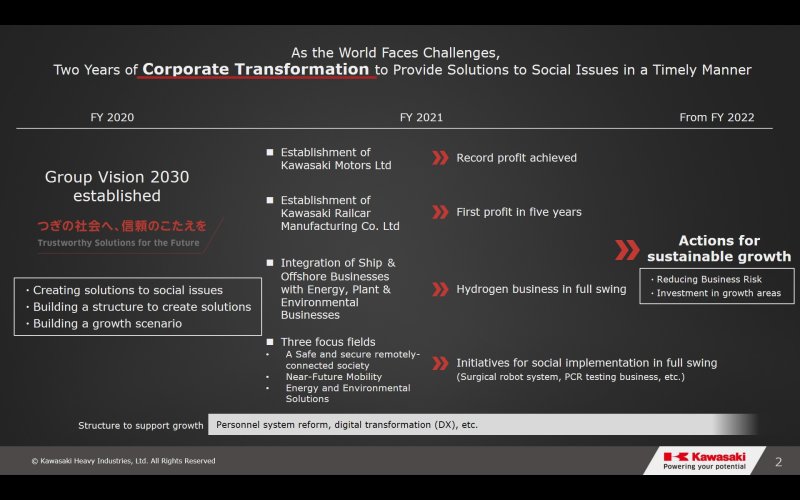

A challenging two years, backed by solid results and realization of growth scenario

President & CEO Hashimoto opened the meeting by noting that since the announcement of Group Vision 2030 in November 2020 , even in the face of challenges posed by the global pandemic, the Kawasaki Group has pressed forward with corporate transformation to provide solutions to social issues. This transformation has included the establishment of Kawasaki Motors Ltd., and Kawasaki Railcar Manufacturing Co., Ltd., as two autonomous 100%-owned subsidiaries, coupled with the integration of ship and offshore businesses with energy, plant and environmental businesses. The core hydrogen business is also making impressive future-oriented progress.

The result of these transformative initiatives has been that Kawasaki Motors has achieved record profits, Kawasaki Railcar Manufacturing has returned to profit for the first time in five years, and new efforts are being made for social implementation of the three focus fields.

In terms of the growth scenario set out two years ago, this has now become a reality with mass production businesses such as motorcycles, precision machinery and robots supporting earnings (80% of total profits), and the aerospace business continuing to recover steadily, coupled with the fact that hydrogen and other new businesses are set to become a pillar for earnings and stable growth in the future.

Hashimoto expressed his commitment this way.

“Social issues are the starting point for Kawasaki solutions, and with the world facing challenges such as carbon neutrality, economic security and logistics challenges, we are confident that the three focus fields promoted by the company will accurately meet the needs of the times.”

Power Sports & Engine segment profitability supported by accurate and swift response

Hashimoto reported that the renamed Power Sports & Engine segment recorded the highest ever profits last year at the same time that Kawasaki Motors was spun off, with a further increase projected for next year. Operating as an autonomous 100%-owned subsidiary means that it is possible to respond quickly to increase production, engage in repricing, and proactively introduce new models, all of which have positively impacted profits. The key to success has been an ability to respond accurately and swiftly to changes in the business environment.

Looking ahead, demand for motorcycles is likely to remain strong, particularly in Europe and the United States, and in the U.S. in particular demand for Recreational Off-highway Vehicles (ROV) and All-Terrain Vehicles (ATV) looks set to drive expansion of business. ROVs are gaining in popularity thanks to their excellent ride quality and payload capacity, being used for both recreation and utility purposes. In the North American market Kawasaki is shifting focus from ATV to higher-value ROV, anticipating industry-wide growth of 1.5 fold in ROV sales by 2025.

In this market environment Kawasaki’s strategies are to: strengthen production capacity by investing more than JPY30 billion by 2025 to double production capacity from 50,000 units to 100,000 units, and to introduce competitive new models every year. Supporting these moves, the U.S. Lincoln plant is set to increase production capacity by March 2023 and a new plant in Mexico is set to go operational in December 2023.

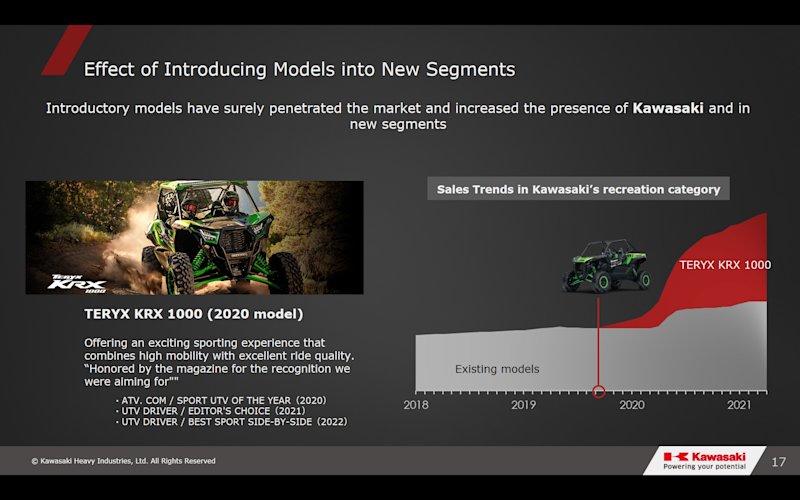

Overall the main market for ROVs is shifting towards faster and larger models, with introductory models in new segments gaining attention and popularity. Kawasaki is therefore aiming to introduce new models in new segments, taking advantage of its unique technologies. One example of such success is the TERYX KRX 1000 (2020 model), which has boosted Kawasaki’s presence in the ROV market. Since its launch the TERYX KRX 1000 alone accounts for almost half of total ROV sales.

In the motorcycle business, demand is expected to remain strong in emerging markets and Kawasaki will maintain its presence while focusing on high-value-added areas with growth potential, and also work to enhance brand strength. In response to the trend towards decarbonization, efforts are also being keenly focused on development of electrified/ hydrogen-powered engines.

In the challenge to become carbon neutral, Kawasaki is leading the industry in moves to electrification, which two models set to be released in 2023, followed by the first strong hybrid motorcycle anticipated in 2024.

Throughout the Power Sports & Engine segment the implementation of digital transformation has significantly shortened development time and reduced development costs, which in turn has been the main driver in boosting operating margins and elevating ROIC.

Rolling Stock segment returns to profitability as a trusted partner in the United States

In the Rolling Stock segment, Hashimoto first highlighted that the company has returned to profitability for the first time in five years, which follows the incorporation of Kawasaki Railcar Manufacturing. The newly incorporated company has concentrated efforts on pursuing contracts at fair prices, focusing on specific markets, all the while leveraging the production expertise of the Kawasaki Group, which had ultimately assisted in the return to profitability. Relatively stable global demand is anticipated for the rolling stock business in the future to increasing capacity in public transport in cities around the world.

Kawasaki is focusing in particular on projects for railway operators in the New York area, where many railcars are in service and Kawasaki can perform the projects through its technical capabilities. Of the 23,000 railcars operating in the U.S., the Northeast Corridor accounts for about 66% of the total, with about 46% in the New York area alone. Since delivering the first R62 railcars in 1983, Kawasaki has been doing business in the U.S. for almost 40 years and its customer-oriented approach has been highly appreciated.

In the New York area Kawasaki provides R211 cars for New York City Transit Authority (NYCT), and since the introduction of Kawasaki railcars the mean distance between failures has significantly improved, with the result that NYCT has identified Kawasaki Railcar Manufacturing as a trusted long-term partner and Kawasaki railcars account for 32% of all NYCT rolling stock in 2022.

Kawasaki has a base contract in place for 535 R211 cars. An option for a further 640 cars valued at US$1.7 billion is a possibility, and there is a further option valued at approx. US$4.4 billion. If option 2 is exercised Kawasaki railcars will account for more than half of all NYCT railcars.

New generation of railcars to contribute to carbon neutrality in Asia

Looking to the domestic and Asia markets, due to the impact of the pandemic there is an order backlog of about JPY150 billion. The domestic rail market has shrunk, but is now starting to bounce back. In Japan, Kawasaki is proposing a new generation of railcars, including hydrogen fuel cell cars to contribute to carbon neutrality in the future.

Across Asia Kawasaki is working on projects in India, Bangladesh and Singapore. Kawasaki considers Bangladesh to be a top priority market for the future, as it advances its first-ever mass rapid transit system.

In terms of the business strategy for domestic and Asian markets, Hashimoto had the following to say.

“Kawasaki will continue to leverage outstanding technical and manufacturing capabilities in a wide range of rolling stock, Shinkansen trains, conventional trains and locomotives, and we will ensure appropriate profits by focusing on competitive advantage, profitability, risk and contribution to business value.”

In the long term the aim in the railcar business is to capitalize on Kawasaki’s strengths in the railcar supply side to boost other solutions for maintenance in emerging economies in Asia and also in North America.

Working to keep people healthy and solve logistics challenges

In terms of progress in “A safe and secure remotely connected society,” and “near-future mobility,” Hashimoto reported that there has been steady growth in the use of the hinotori™ surgical robot system, and Medicaroid has start ed a pilot experiment that looks to the future of telemedicine. hinotori™ was the first domestically-developed surgical robotic system to receive manufacturing and marketing approval for various uses in Japan, and the approval covers approximately 90% of all robotic surgeries performed in Japan.

With regard to PCR testing and Kawasaki’s contribution to the restoration of social mobility, the testing business was launched in just one year and a cumulative total of 700,000 people have been tested. Using robots in this system has proved to be very effective and Kawasaki continues to provide services at airports, and to local governments and hospitals.

In the field of robotics Kawasaki is engaging in new business with major companies to collaborate beyond traditional business areas to create new solutions. An example is the establishment of Remote Robotics, Inc., a joint venture with Sony Group Corporation, that aims to create a remote society in which all people can participate.

In terms of near-future mobility, such as unmanned vertical take-off and landing aircraft (VTOL), as one of the leading domestic manufacturers in this field Kawasaki is working to provide solutions for both the defense and civilian sectors, in an example of dual use, helping to solve logistics-related problems in civilian areas, and support defense and disaster-reduction-related areas too.

In terms of the indoor positioning system iPNT-K, which uses Wi-Fi to locate people inside buildings, where GPS cannot reach, demand for indoor positioning services is anticipated to continue to expand to JPY1.17 trillion in 2035. The company has received more than 600 inquiries about iPNT-K since July 2021 and the service already covers more than 15,000 floors in 1,300 facilities nationwide.

Wrapping up his presentation, Hashimoto pointed to the previously announced forecast for fiscal 2022, noting that Kawasaki has been cautious in its projections, due to the pandemic and other negative factors on management. The Power Sports & Engine segment is driving profitability currently, which is expected to continue into fiscal 2023 as sales remain buoyant. Profitability in Precision Machinery and Robot segment is projected to increase, coupled with further profits in the Rolling Stock segment. The forecast for fiscal 2023 is therefore for increased revenues and profits across the entire Kawasaki Group.

Looking to expand hydrogen frontiers with an international hydrogen supply chain

The next subject was about energy and environmental solutions. Eiichi Harada, General Manager of the Hydrogen Strategy Division spoke about Kawasaki’s initiatives towards achieving carbon neutrality, in particular the progress of the hydrogen business, which is a key pillar for the group.

Harada reported that in February 2022 Kawasaki completed the first international hydrogen supply chain pilot project, with the world’s first international liquefied hydrogen transportation on board the SUISO FRONTIER a liquefied hydrogen carrier, which attracted international attention.

There are three steps towards realizing a liquefied hydrogen supply chain, starting with the pilot demonstration completed this year, after which will come the construction of a business scheme to demonstrate commercial viability, and then the launch of commercial chain operations (from 2030 onwards).

To engage in these steps and realize a commercial supply chain business, Kawasaki established Japan Suiso Energy, Ltd. (JSE), in June 2021, which aims to consolidate operations and know-how related to hydrogen production and transportation, as well as to accelerate the establishment of a commercial chain.

The business scheme for the hydrogen supply chain that JSE will operate consists of hydrogen equipment suppliers like Kawasaki and hydrogen consumers. JSE will place equipment orders to suppliers and supply hydrogen to consumers.

In terms of the commercial scale development, efforts are being made towards achieving critical mass for commercial operation, including the February 2022 pilot project. Kawasaki will continue to evaluate the possibility of commercialization and make efforts to increase the size of the hydrogen transport vessel by 128 times and the receiving tank by 20 times. Development of commercial-scale equipment is underway at Kawasaki.

Kawasaki stepping up to develop hydrogen as a first mover

With regard to the launch of the commercial supply chain and government moves to accelerate social implementation of the hydrogen society, in 2021, a total of JPY2 trillion was created for a Green Innovation Fund. In the near future new GX Economic Transition Bonds to a value of JPY20 trillion are expected to be established to attract business conversion and private investment, and discussions have begun on a new support system using these bonds as a source of funding. From the perspective of economic security, the importance of new energy sources such as hydrogen is growing, and government support for their smooth introduction is crucial for social implementation going forward.

In this regard, the Japanese government is looking into supporting “first movers” to promote the introduction of hydrogen energy systems for businesses that are planning to launch commercial operations by around 2030.

The current outlook is that the price of hydrogen will be equivalent to that of existing fuels by around 2050, when the use of hydrogen becomes widespread, but conversely, the price is expected to be higher than that of existing fuels until then. Through government support for equipment installation and compensation for the price difference of hydrogen compared to existing fuels, it is expected that users will be able to use hydrogen at the same price as existing fuels from the early stage of hydrogen introduction from around 2030.

Kawasaki is working with other first mover operators, such as Kansai Electric Power Co., Inc. and is aiming to meet expectations for the social implementation of hydrogen such as hydrogen power generation in 2030 through the supply of commercial-scale equipment.

Aiming to become a pioneer in decarbonization using hydrogen

Harada also referred to Kawasaki’s efforts to become carbon neutral in its domestic operations through zero-emission plants centered on hydrogen power generation, which had been raised as a part of hydrogen strategy in the previous year’s report. Kawasaki has begun specific studies on the locations of hydrogen power plants, with a view to starting operations in 2030. Plans are to invest approximately JPY50 billion.

Kawasaki has a lineup of hydrogen-compatible gas turbines that can be used with 100% hydrogen, 100% natural gas or any mixture of the two. Kawasaki’s gas turbines have gained a great deal of attention from overseas. In addition to the joint-demonstration project with German energy company RWE Generation SE (RWE), recently an order was received from Chevron Phillips Chemical International N.V. to convert existing 1MW gas turbines to hydrogen co-firing turbines.

In terms of the outlook for our hydrogen business, Harada reported that Kawasaki anticipates that business scale will increase dramatically from approximately JPY5 billion in fiscal 2024, to JPY52 billion in fiscal 2025, driven by progress in commercialization pilot tests. Business is anticipated to grow still further by fiscal 2026 to a scale of JPY130 billion. By fiscal 2030, assuming that a hydrogen supply chain can be created among first-mover operators, Kawasaki expects the hydrogen business to increase to a scale of approximately JPY400 billion.

Potential for DAC to achieve true carbon neutrality

In terms of initiatives to capture and store CO2 from the atmosphere, to achieve true carbon neutrality in the future requires the development and commercial use of Direct Air Capture (DAC) technologies. This is a key technology and one that Kawasaki is focusing on for the future, but still faces technical hurdles, including the need to remove low-concentration CO2 using as little energy as possible.

Kawasaki has a wealth of experience with DAC technologies in submarines and other equipment. In 2022 a pilot experiment was launched to capture and store low and ultra-low concentrations of CO2 from the atmosphere. Although challenges remain, Kawasaki’s DAC technologies are among the most advanced in the world.

The market environment for DAC technologies is changing rapidly and in the United States, the recent Inflation Reduction Act (IRA) stipulates subsidies of up to US$180 per ton for DAC CO2, significantly improving the economics of DAC. The DAC market is expected to expand rapidly, particularly in North America. Kawasaki is aiming to realize commercial operations in markets where there is economic potential for DAC, and need to have a certain demonstration experience for DAC to underground storage. Kawasaki and INPEX Corporation are conducting a feasibility study with a view to launching a domestic demonstration for underground storage of CO2, and Kawasaki would like to involve its DAC technology in this demonstration.

Q&A – Hydrogen and carbon neutrality leading the way to 2030

In an extensive Q&A session top executives responded to questions from press and industry analysts. Key questions about the hydrogen business focused on Kawasaki’s initiatives to work with other companies and partners in establishing a supply chain. Hashimoto emphasized Kawasaki’s key role in the chain.

“When it comes to transporting liquefied hydrogen other than through pipelines in the supply chain, we are the only company that can actually demonstrate the use of liquefied hydrogen carriers. We are receiving calls from all over the world for technologies that only we can provide, and there are still many projects that we have yet to explore.”

Asked about the earnings drivers for KHI in 2030 and how the business portfolio will look, Hashimoto responded that the aim is to develop a portfolio where Kawasaki is a company that can make profits not only in manufacturing but also across the entire hydrogen industry. Hydrogen engines could be a key part of the motorcycle business too by the 2030s, supporting growth in the Power Sports & Engine segment. The company will continue to pursue major markets, such as electrification of engines for carbon neutrality, based on product strategies and also concentrate on enhancing management efficiency.

Critical importance of HR reforms in corporate transformation

On the topic of human resources mobility, Hashimoto emphasized that this is one of the critical elements for realizing corporate transformation. It is already the case that enhanced mobility among and within group companies has increased dynamism, with personnel being assigned to areas where they are most needed. Kawasaki is also actively bringing in various people with a diversity of skills from outside the group to concentrate and enhance know-how. It was noted that forming a diverse and internationally-oriented workforce is key to building experience and growing the value of the company as a whole. As the Kawasaki Group continues its journey towards the realization of Group Vision 2030, it will continue to be proactive in bringing together a full spectrum of talents, and take the lead globally in realizing a hydrogen society.