Kawasaki's "Other side": Supporting Tricycle Drivers' Financial Independence

Kawasaki has been implementing various initiatives to promote a culture of innovation within the Group and to strengthen its activities for attaining Sustainable Development Goals (SDGs). One such initiative is taking place in the Philippines ― Investment in GMS which aims to support tricycle drivers in overcoming poverty and achieving independence and prosperity.

Helping Tricycle Drivers Increase Income by Investing in Global Mobility Service, Inc. (GMS), Which Supports Drivers’ Independence

In addition to producing localized products, Kawasaki has committed itself to helping tricycle drivers become financially independent and to resolving various social issues in the Philippines. One such initiative was an investment in Global Mobility Service, Inc. (GMS). Led by CEO Tokushi Nakashima, GMS provides loan assessments and creates financial opportunities for tricycle drivers so they can get new machines, making use of FinTech (financial technology) and IoT (Internet of Things).

In the Philippines, 77% of the people do not have bank accounts, and 90% of tricycle drivers belong to the poorest segment of society. Most drivers operate their tricycle business by renting their bikes from owners for about 150 pesos (300 yen/US $3) a day, or about 9,000 pesos a month. Buying a new Barako to go with their sidecar is possible by taking out a loan with a monthly payment of 5,000 pesos, making the machine their own property. However, not having a bank account or even enough money for a down payment, they lack credit, resulting in most of them continuing to do business with rented tricycles. This vicious cycle has widened the income divide in the country.

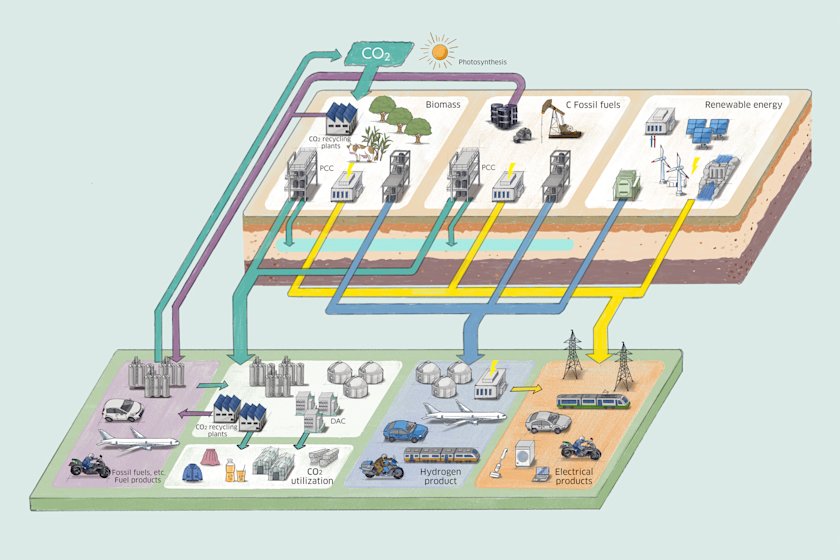

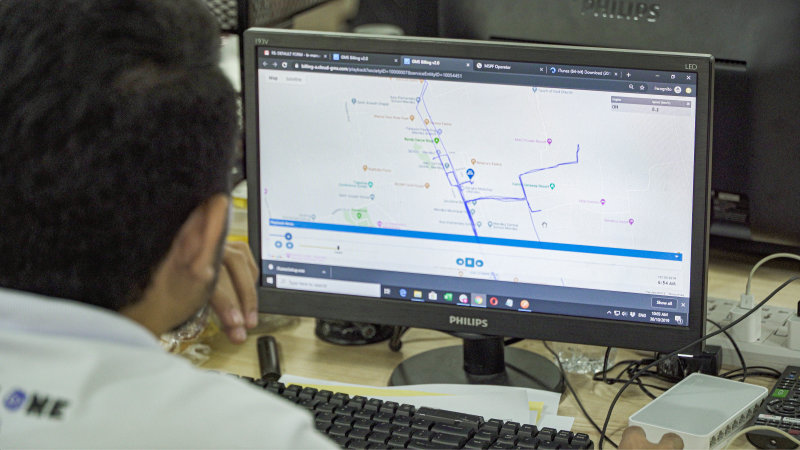

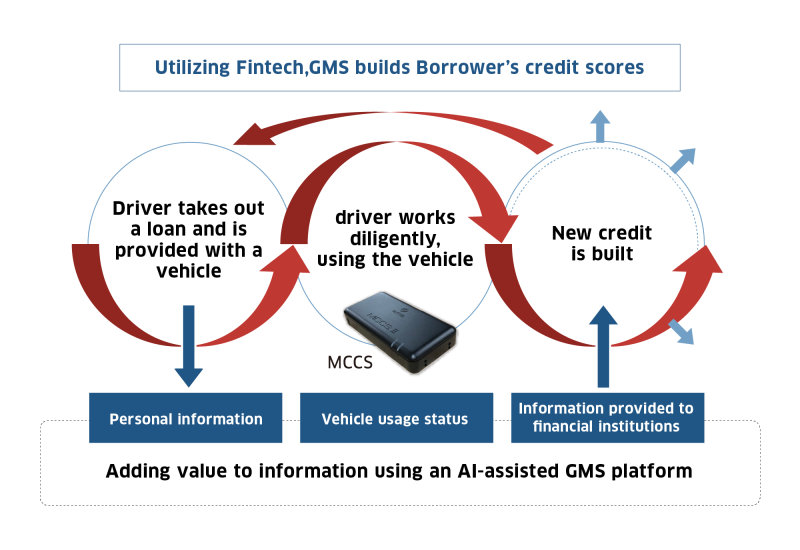

To stop this cycle, GMS came up with a business model built on a fusion of FinTech and IoT. In this model, the driver takes out a loan and is provided with a tricycle equipped with GMS’ proprietary IoT “Mobility-Cloud Connecting System” (MCCS) device, which has remote control capability. Data regarding mileage, routes taken, operating time, etc. is stored in the cloud in a “Mobility Service Platform” (MSPF). Loan payment status is linked to the MSPF and if payments fall in arrears, the system remotely disables the ignition, and a staff member is assigned to find out the reason and provide support.

GMS COO Kazumasa Nakashima comments, “After successfully paying off the three-year loan, the data accumulated during that period becomes the driver’s credit history, which can help him purchase a second vehicle, take out a loan for his children’s education, or take other steps to become financially independent. To be more specific, GMS is offering loans on the basis of a simple credit check, with the new tricycle as collateral, and the driver’s payment record will be the means of building up his credit score. This business model therefore provides the first step towards eradicating poverty.”

In 2015, using its own resources, GMS began creating credit. While banks’ default rates (the percentage of loans remaining unpaid after an excessive amount of time) have generally been around 20%, GMS has achieved an amazingly low rate of 0.9%. Based on this performance, a number of financial institutions, including local banks, decided to provide funds to GMS, which has enabled the company to grant credit to a total of 8,000 tricycle drivers, with 400 being added on a monthly basis. Nakashima adds, “One tricycle driver, who built up his credit score enough to take out an automobile loan in order to switch to driving a taxi, now earns five times more annually than before.”

Kenny Rhollie Mingo, a 30-year-old GMS loan user, says, “I took out a loan totaling 180,000 pesos (360,000 yen/US $3,300) and repaid half in 18 months. I am confident that I can pay off the rest. In the future, as a tricycle owner, I’d like to own five motorcycles for the benefit of my family.” His wife, Nelia Afable, standing next to her husband, says laughingly, “Our dream is to have our own house, and because both my husband and the Barako are durable, it probably will happen.”

In June 2018, in conjunction with other listed companies, Kawasaki invested in GMS. Commenting on the reason for the investment, Makoto Noda, Associate Officer/General Manager of the Innovation Department at Kawasaki’s Corporate Planning Division, says, “We see solid integrity in GMS’s vision for resolving social issues.”

Adding that it was a meaningful way to expand Kawasaki’s activities in fulfilling the Sustainable Development Goals (SDGs), he says, “The Barako II is symbolic of Kawasaki’s contributions to society by means of our products ― a conventional model. However, investing in GMS and partnering with the company is a more pro-active, ‘aggressive SDG model,’ focused on poverty eradication ― Goal 1 of the SDGs. I hope to earn more support for such innovative initiatives from Kawasaki employees and strengthen partnerships with outside entities, so as to continuously create business for Kawasaki.”

This is Kawasaki’s “Other Side” ― social contribution and sustainable value creation.

Innovation Department

Kawasaki Heavy Industries, Ltd.

Global Mobility Service Philippines, Inc.